2025

DCC completes the sale of DCC Healthcare and DCC Technology's Info Tech business - a material step in the Group’s strategy to simplify operations, maximise shareholder value and accelerate the growth of its energy business.

2024

DCC celebrates 30 years as a public company. In November 2024 DCC annouced decisive action to simplify the Group's operations and focus the Group on the energy sector.

2022

DCC announces a new strategy for its energy businesses.

2021

DCC delivered a strong performance during the COVID period, with adjusted operating profit up 7.3% to approximately £530 million for the year ended March 2021. Our essential products and services across energy, healthcare, and technology played a critical role in supporting economies through the crisis.

2018

DCC Healthcare completes its first acquisition in the US Health and Beauty sector: Elite One Source Nutritional Services.

DCC Technology purchases Stampede – also its first foray into North America.

2017

DCC disposes of its Environmental division.

DCC LPG enters the large US LPG market, acquiring Retail West, known today as DCC Propane.

Donal Murphy succeeds Tommy Breen as Chief Executive in July 2017.

2015

The Group completes its two largest acquisitions to date by entering the French LPG market, buying Butagaz from Shell and ESSO SAF’s unmanned and motorway retail petrol station network in France.

In December 2015, DCC is included in the FTSE 100 index.

2014

DCC disposes of its Food & Beverage division, bringing sharpened strategic focus to the Group’s operations.

2009

DCC Energy expands into the liquid fuel distribution market in Continental Europe for the first time with the acquisition of Shell’s business in Denmark and Austria.

2008

Tommy Breen succeeds Jim Flavin as Chief Executive.

2000-2005

DCC acquires BP’s business in Scotland – marking its first entry into the UK liquid fuels sector.

Then in 2005, DCC Energy enters the Fuelcard market in the UK. Operating profit now surpasses £220 million.

1998-1999

DCC enters the UK Healthcare market. It begins by purchasing two UK health and beauty businesses, EuroCaps and Thompson & Capper in 1998 and 1999.

1994

DCC lists on the London and Dublin stock exchanges on 19th May 1994. At the time, it had revenue of €302 million and operating profit of €21 million.

1990

From 1976 to 1990 DCC grew to become Ireland’s number one venture capital business. The most successful investments tended to be those where DCC had most input and control.

This, coupled with a broader growth ambition, led DCC to transition from a venture capital business to an operating group over the following years. The company amends its name to DCC. Strategic change begins: DCC disposes certain investments to concentrate on the Energy, Healthcare, Technology, Environmental and Food sectors.

1988

Investments in Sharptext (Ireland) and Micro-P (UK) in the Technology distribution sector. Today these businesses are known as Exertis.

1982

Investment in Hospital Enterprises, the forerunner for today’s DCC Vital business within the Healthcare division, DCC’s first investment in Healthcare.

1977

First investment in the Energy sector with the acquisition of Flogas, an Irish LPG business.

1976

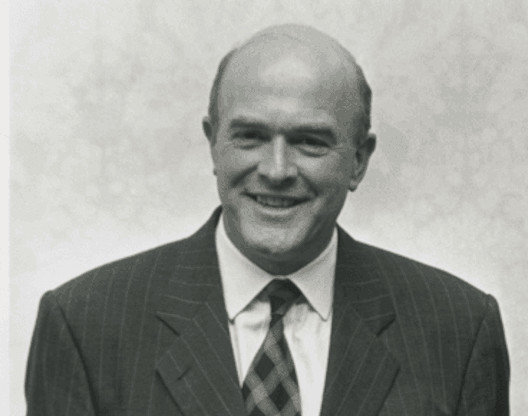

DCC was founded by Jim Flavin in 1976 as Development Capital Corporation Limited. Originally, the company focused on providing capital to growing unlisted companies. DCC brought business development and corporate finance skills to its investments - as it does to this day. In essence, it was Ireland's first private equity vehicle.

Jim was DCC’s first Chief Executive and led the company for 32 years of unbroken growth until his retirement in 2008. He laid the foundation for the Group's focus on maximising return on capital, cash generation, management development and operational excellence.